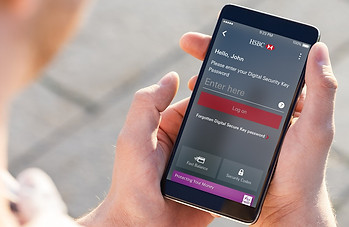

HSBC

Retail banking application

Being a global bank, HSBC provides the best banking experience to their customers. However, as the digital world advanced, HSBC lacked in providing their services for what we now know is the fastest and easiest way of banking.

Essential services and features were found to be missing from both browser and mobile application of HSBC in multiple markets (countries).

My role

In a team of 8 UX designers, I have a crucial role. My involvement in launching a feature started from the very beginning - interaction with key market stakeholders to understand the requirement, the business value it would add to every market, pain points of current process, etc. I am working in an agile team where I work closely with multiple product owners across 30 POD teams.

Besides managing multiple features end-to-end, I, also trained and gave guidance to other (junior) team members who were fairly new to the working league.

Keeping the team engaged & working harmoniously became key when the pandemic hit. I saw a lot of disconnect between the team members and took charge of connecting the team through some fun activities.

Design processes

At HSBC, there are hundreds of team and UX designers, working towards the same goal, across the globe. With such a large team, it is imperative to have a design process and a design system in place. There are multiple processes such as Digital Governance Process, Design Thinking, etc set in place to achieve a uniform product.

Lets see what these are in more detail.

Digital governance process

Digital Design governance helps ensure that Global Businesses and Global Functions proactively engage customers and other stakeholders through HSBC's websites and mobile apps in a positive, controlled and structured manner, while protecting the interests of all involved from risks inherent in digital channels.

Any new feature or a major enhancement in any section of the app has to follow this process.

Digital governance process

Step 1: Start governance - We (project team), needs to give an introduction of the project to the governance team who then help us with the guidelines we need to adhere to.

Step 2: Experience review - During the phase of UX design, we align to our Design Thinking guidelines. We run several user testing, ensure the design is cleared for all accessibility tests and provide a seamless experience. With a vast application like HSBC's, it is important that every feature carries the same look & feel and provides a hassle-free experience. This is where I, as a UX designer, initiate interactions and review sessions with the digital governance team, who ensure all UX standards are met.

Step 3: Build review - By this stage, we are ready with a developed product which goes through various rounds of testing such as UX/UI testing, accessibility testing, business testing & user acceptance testing (UAT). Once the feedback from individual testing is completed, the build goes to digital governance team, who run final testing and ensure all feedback is implemented.

Step 4: Project approval - During the final stage, we, the project team, is required to provide sign-offs from all departments - UX, market, analytics, legal, compliance, etc. Along with this, we also present the final testing reports.

Once the design governance team provides us with the approval, the feature is ready to be launched for our customers.

Design thinking

Design thinking is a methodology for creative problem solving. An approach to make creative ideas, focusing on the human needs behind them. At HSBC, we need a consistent way of delivery value for our customers and our business. So we endorse a recognised approach to Design Thinking that can be seen in the approaches promoted by the Stanford d.School.

We take the approach of five familiar stages:

-

Empathise

-

Define

-

Ideate

-

Prototype

-

Implement

Along with this, we added three more steps to reflect the requirements of our internal teams, business operations and existing development processes. These are:

-

Mobilise

-

Assess

-

Optimise

Design thinking

Step 1 - Mobilise

We set ourselves up for success by making sure our project has an unbiased problem statement/opportunity area, agreed scope and clear deliverables.

Step 2 - Empathise

Its vital that we develop a deep understanding of the customer needs, motivations and frustrations to help us define the right problems to solve.

Step 3 - Define

We turn our findings into insights, sharpen problem statements and articulate design challenges that we can act upon.

Step 4 - Ideate

The Ideation process helps us look beyond the obvious, to co-create a promising range of potential solutions that have value for our customers and for our business.

Step 7 - Assess

It is important to measure the success of live solutions with user's feedback and data, ensuring original objectives are being met and/or uncover new opportunities to continually improve and continually deliver value.

Step 5 - Prototype

This stage enables us to de-risk the delivery by bringing idea to life, testing them with customers and colleagues to gain feedback, confirm their value and iterate, based on evidence.

Step 6 - Implement

During this stage, we work with the development teams to translate ideas and prototypes into delivery, getting solutions to market.

Step 8 - Optimise

The Optimise phase sees us prioritise areas for improvement, define the next problems and scope the resources required to understand, explore and solve them.

Journey highlights

Raising a dispute

Disputing a transaction has never been an easy task for any bank. There are very few banks in the world that provide this functionality on a digital platform. Hence, for most of the banks, this means high number of calls made to the bank, essentially increasing the cost for them. On an average a call made for raising a dispute takes about 15-20 mins in order to get all the required details from the customers.

HSBC is one of the first global banks to digitalise this process from start to end. By making this functionality available to customers on the mobile platform, it is now easier, faster and seamless to raise a dispute.

Showcased are few screens below from this feature.

Challenges, insights, solutions...

For a journey that didn't have a lot of digital presence in the market, a thorough user testing was necessary. With the support of internal user testing team, we did multiple rounds of tests to understand a user's mindset while performing this journey.

We received various insights that helped us in providing the best solution to the customers. Some of them being -

a. Customers weren't willing to read through a lot of big chunks of text

b. A lot of questions were difficult to understand for customers

c. For some questions, customers wanted to provide more information

d. They felt the absence of human interaction

We took all of these pointers into consideration and reiterated our designs several times. The most challenging was bringing in the human touch. As a solution for this, we presented the questions one at a time to make it more interactive with the customers.

Customer details

One of the most basic, yet extremely critical feature for a bank, lacked its presence on the digital platform from various markets. Bringing in a global solution was designed keeping in mind various platforms (mobile, browser and in-branch), giving a seamless experience throughout.

Capturing a customer's contact details, their personal and employment information is generally part of the onboarding process. But providing the customers the feasibility to update their information in the simplest and most accessible way is crucial.

Challenges, insights, solutions...

For any other domain, contact information of a customer may not hold much importance, but that is not the case for a bank. As a bank, we need the information to not only send out promotional ads but also be able to reach the customers in case of any fraudulent activity on their accounts.

Although, while opening an account, it is mandatory for a customer to provide us with their details, however, HSBC being an old bank, we found a lot of customers did not hold these details. Some of these details were made mandatory to be provided and alerts were sent out to such customers.

It is also important to build trust with the customers by allowing them to change their contact information without providing any proofs. Customer's personal and employment information gives us the confidence to track for any fraudulent events.

Results achieved

The feature of 'Customer Details' was released in several markets across globe on mobile platform and we received some exceptional results from each of these markets. Within a few hours of releasing the journey, there were hundreds of customers coming here to update their information. Along with satisfying the customers, we also helped the bank save a lot of manual effort.

While 'Customer Details' saw a success, 'Raising a Dispute' was ranked 3rd best banking feature in the UK. The results we got were not anticipated. By digitalising this feature, we were able to reduce the number of calls coming in to our call centers by a huge amount.